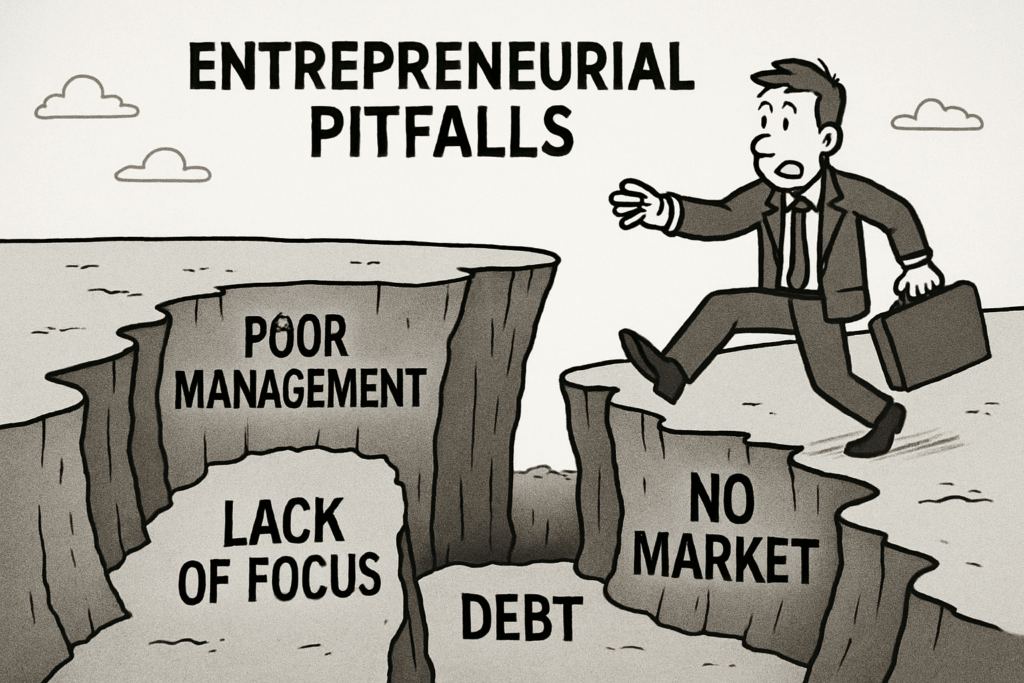

Entrepreneurial Pitfalls: The Most Common Mistakes to Dodge

- Starting a business is thrilling—but it’s full of hidden traps.

- This guide unpacks the biggest entrepreneurial pitfalls facing new founders in 2025.

- With practical, straight-talking advice, we’ll help you skip the regrets and keep your fresh venture on solid ground.

Entrepreneurial Pitfalls: The Most Common Mistakes to Dodge

Starting a business is a wild ride—equal parts adrenaline rush and anxiety spiral. On day one, the horizon looks full of promise. But step off the starting line without looking for potholes and you’re begging for a sprained ankle (or worse, a faceplant). The reality? Founding a company in 2025 means dodging a ruthless set of mistakes that are both classic and constantly evolving.

Let’s skip the sugarcoating. Early-stage blunders are rarely subtle. Whether it’s ignoring the market, torching through your savings, or trying to be your own accounting, HR, and sales department, the errors pile up fast—and they rarely forgive. This isn’t about pessimism, it’s about practicality: see the traps, plan for them, and you’ll move quicker, smarter, and further.

This article isn’t here to scare you off. It’s here to hand you a blueprint: the biggest, baddest entrepreneurial pitfalls waiting to trip up new founders in today’s market. We’ll break them down, show you what to look for, and—most importantly—give you hands-on advice for sidestepping disaster before it happens.

Ready to play the game with your eyes open? Let’s talk about what not to do, so your new venture gets to write an origin story that doesn’t start (or end) in the ditch.

Underestimating Startup Challenges

There’s a certain energy that comes with launching a business. Ideas fly, optimism soars, and suddenly you’re knee-deep in Google Docs or pitching your elevator speech to anyone who’ll listen. But here’s the unpolished truth: most new founders run straight at the wall with their eyes half-closed. The biggest mistake? Underestimating what lies ahead.

Let’s cut to it. Too many entrepreneurs ignore the slog of real market research. They rely on gut feeling and excitement—assuming the world will love their product just because they do. That’s how you end up with shelves full of unsold widgets or a shiny app no one needs. The harshest blow? Finding out too late that your brilliant idea isn’t all that original, and your would-be competitors have already gobbled up the market.

Don’t gloss over this. Before you pour your savings (and weekends) into building, make sure there are actual, breathing customers out there. Study the demand, kick the tires on your competition, and accept that your first assumptions are probably off. The entrepreneur’s edge isn’t just hustle—it’s the willingness to dig, question, and take a hard look at the landscape before going all-in. The challenge is bigger and messier than you think. Start smart.

Neglecting Financial Basics

Let’s be clear: running out of money is the fastest way to crash, no matter how groundbreaking your idea is. Yet, far too many new entrepreneurs treat bookkeeping like an afterthought, hoping passion will pay the bills. It won’t. Get a handle on your cash flow from day one. You’re probably not making as much as you think, and things often cost twice what you expect.

Big mistake #1: spending too fast. Splashy offices, glossy branding, and pricey tools look good on Instagram, but they can bleed you dry before revenue catches up. Be ruthless about what’s essential. Bootstrap where you can, and focus spending on things that actually drive growth.

Big mistake #2: underpricing. In the scramble to land new clients or users, it’s tempting to set prices low. Don’t sabotage yourself. Know your value, understand your costs, and make sure your prices reflect both. Cheap isn’t always better; sometimes it’s just unsustainable.

Big mistake #3: no emergency plan. Startups are rollercoasters. Assume the unexpected will happen—lost deals, delays, broken equipment, you name it. Set aside a small buffer. It’s not “extra money”; it’s survival.

Finally, don’t overcomplicate it. Download a basic bookkeeping app or spreadsheet, track every dollar in and out, and review your numbers regularly. Keeping lean early buys you time, options, and peace of mind. Handle your finances now, and you’ll still be in business when others are making excuses.

Going Solo (and Burning Out)

Let’s be blunt: no one builds a company alone—not really. Sure, you can code the website, pitch the idea, do customer support, sweep your office floor, and still somehow send out marketing emails at 3 a.m. But that’s not heroism; it’s a recipe for burnout.

Too many new founders try to do everything themselves. Sometimes it’s pride, sometimes it’s saving cash, sometimes it’s not trusting anyone else to do it “right.” Here’s the truth: the solo act is unsustainable. You miss perspectives, make tunnel-vision decisions, and end up stretched so thin you forget why you started at all.

You don’t have to find a co-founder if that’s not your style, but you do need sounding boards. Build a circle—mentors, advisors, maybe an early team. Steal some wisdom from those who’ve seen the battlefield. Getting feedback on key moves (and having someone call out when you’re veering off course) is non-negotiable. Take a look at the role of sustainability in modern startups for insights on how smart founders share the load.

Bottom line: stubborn independence will slow you down and burn you out. Share the load. Protect your energy. The journey’s long—don’t make yourself the only passenger in the car.

Forgetting the Customer

Here’s the classic trap: founders get so wrapped up building the “perfect” product that they forget to ask whether anyone actually wants it. It’s way too easy to chase your own vision down a rabbit hole, mistaking your preferences for universal needs. The bottom line? The market doesn’t care about your genius—only about its own problems.

Feedback isn’t just a box to tick. It’s the lifeline that keeps your business relevant. Test early ideas on real users—friends and family don’t count (they’ll lie to spare your feelings). Take criticism on the chin. The sooner you hit painful truths, the faster you can pivot and avoid sinking time into something nobody loves.

Watch for founder errors like ignoring customer pain points or brushing off complaints as “one-offs.” If your target audience keeps tripping over the same flaws, listen—then move fast to fix them. Your original vision matters, but adaptability matters more. Build for them, not just for you. That’s how ventures survive.

What Happens After Winning Millions?

Winning a life-changing lottery jackpot is every player’s dream, but few are prepared for what comes next. The sudden influx of wealth can bring exhilaration yet also a wave of challenges. Many winners find themselves overwhelmed by financial decisions, from managing taxes to making smart investments. Some handle it well, while others fall into reckless spending that drains their fortune faster than expected.

The Financial Reality of Winning

Many winners face critical financial decisions almost immediately:

- Taxes and Legal Issues

- A significant portion of the winnings often goes to taxes.

- Failing to plan can lead to legal troubles.

- Investing vs. Spending

- Some winners hire financial advisors to ensure long-term security.

- Others spend impulsively without a plan.

- Budgeting for the Future

- Without proper money management, even the biggest jackpots can vanish quickly.

A Lifestyle Overhaul

A sudden fortune changes life in more ways than one:

- Luxury Purchases

- Mansions, sports cars, and extravagant vacations become instantly affordable.

- Social Pressure

- Long-lost friends and distant relatives often reappear, expecting a share of the winnings.

- Privacy Challenges

- Some winners struggle with unwanted media attention and public scrutiny.

While some winners embrace their new wealth openly, others choose to live discreetly to avoid pressure and expectations.

Giving Back and Creating a Legacy

For some, wealth is not just about personal luxury—it’s an opportunity to make a meaningful difference. Many winners choose to:

- Contribute to Charities

- Donations to charitable organizations and community projects become a priority.

- Fund Education

- Many winners fund scholarships and support education initiatives.

- Invest in Communities

- Investments in businesses that create jobs and opportunities help rejuvenate local economies.

Some lottery winners transition from players to philanthropists, illustrating that wealth can be harnessed to leave a lasting impact. However, not all stories end positively—many who fail to manage their winnings properly find themselves bankrupt within years.

Scaling Too Soon (Or Not Enough)

Growth gets all the headlines, but rushing into expansion is a classic way to tank your startup. It’s tempting to hire a big team, splash out on a fancy office, or pump money into marketing when you see a few promising signals. The truth? Unless you’ve nailed product-market fit, scaling just means burning cash faster while amplifying your weaknesses.

Overhiring saddles you with payroll, office drama, and the dreaded feeling of running a company built on hope instead of confirmed demand. Pouring funds into ads before your product truly fits the market is like shouting into the void—expensive and pointless. Many founders stall out not because the idea was bad, but because growth came before readiness.

The flip side isn’t clever, either: staying “small” too long makes you slow and invisible. If you’re afraid to invest in operations, staff, or quality upgrades once you actually have traction, others with deeper pockets or bolder attitudes will pass you up. Missing the window for real growth leads to stagnation, and eventually, irrelevance.

Here’s the middle path: scale with brutal honesty. Keep checking if your product really solves a problem, watch your metrics like a hawk, and don’t let ego or fear drive your timeline. Grow only when you can serve more customers without letting quality slip. Sometimes the smartest move is saying “not yet”—and then, when it’s time, going all in.

Learning from Others

You can spend years learning lessons the hard way, or you can shortcut the pain by observing entrepreneurs who’ve already taken the punches. There’s zero glory in stubbornness when it comes to dodging classic mistakes. The best founders are obsessive note-takers—on other people’s wins, failures, pivots, and damn disasters.

Sit down with seasoned business owners over coffee, scroll through forums, and dive into books full of business post-mortems. Look for patterns—what repeats? Which regrets get confessed again and again? That’s not background noise; it’s premium intel. And don’t cherry-pick just the stories of wild success. The flame-outs often teach just as much, sometimes in fewer words.

One more thing: don’t get hung up on ego. Smart founders ask dumb questions and admit what they don’t know. Find mentors, hit up local meetups, or reach out online. The entrepreneurial community is full of people who can help you sidestep the landmines they already found. For a list of cautionary tales and real strategies from the field, check out this common pitfalls article. Learn from the past; you’ll save time, cash, and maybe your sanity.

Their experiences highlight that handling sudden wealth requires a thoughtful approach and careful planning. The choices winners make not only shape their financial future but also define the legacy they leave behind. Whether through personal indulgence or philanthropic ventures, the path taken can resonate for generations. Embracing the opportunities and responsibilities that come with such an unexpected windfall ultimately shapes the true value of their winnings.